Recaps of insurance coverages and policy attributes are for educational functions only. In the event of loss, the actual conditions state in your policy will certainly identify your coverage. AARP as well as its affiliates are not insurance companies. Paid recommendation. The Hartford pays nobility charges to AARP for using its copyright.

It is underwritten in AZ by Hartford Insurer of the Southeast; in CA by Property and Casualty Insurance Business of Hartford; in WA, MI and MN, by Trumbull Insurance Coverage Business; in MA, by Trumbull Insurance Provider, Sentinel Insurance Policy Firm, Hartford Insurance Provider of the Midwest, and also Hartford Crash as well as Indemnity Firm; and in PA, by Hartford Underwriters Insurer.

Financial savings as well as benefits might differ and some applicants might not certify. The Program is currently inaccessible in Canada and united state Territories or ownerships. * Client evaluations are accumulated as well as arranged by The Hartford and also not rep of all clients - suvs.

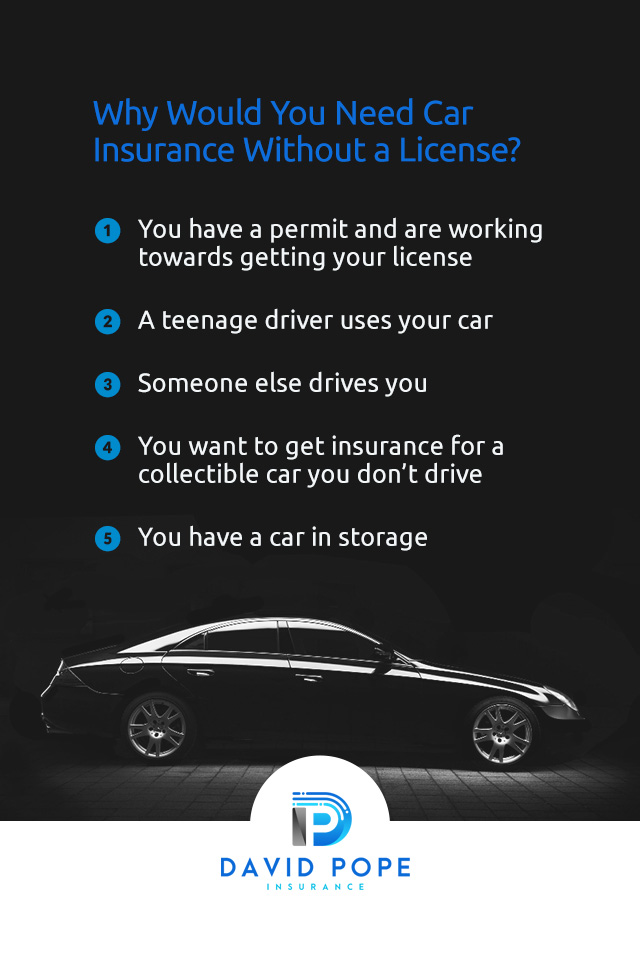

Buying a auto insurance coverage when you do not have a valid driver's license may appear meaningless. Besides, several vehicle drivers might assume the only reason a chauffeur needs automobile insurance is if they have a valid license. Nonetheless, that is not always the case. You can, and also possibly may need to have auto insurance coverage if you do not have a legitimate driver's permit, although oftentimes, locating an insurance coverage service provider to cover you without any license insurance policy will be a little harder than regular.

Some Ideas on Florida Insurance Requirements You Should Know

credit score low-cost auto insurance cheapest car vans

credit score low-cost auto insurance cheapest car vans

However, purchasing car insurance policy without a license is feasible, as well as also necessary, in certain scenarios. Reasons to buy auto insurance policy without a license, We know it appears strange to suggest somebody that is not obtaining behind the wheel of a car would certainly require car insurance, but there are situations where having a plan without a license might be in your best rate of interests - auto insurance.

If you are putting your cars and truck in storage space for a while and also your certificate expires while you recover, you may still desire automobile insurance coverage to safeguard you as well as your automobile in case that anything were to occur to your automobile while in storage space. You might additionally want to keep a vehicle insurance coverage policy if you believe you might drive once more in the future to stay clear of a gap in protection, which could make your price higher when you need insurance coverage once again.

You are being driven to and also from visits, job or anywhere else, If you are an elderly that has lost your permit or is not comfy driving, you may have a more youthful loved one or caregiver take over as your driver. Also if you are not the primary vehicle driver for your auto, you still need auto insurance policy to cover your lorry (automobile).

Listing another person as the vehicle's primary chauffeur will not constantly be a choice unless the individual who drives you is a part of your household.

The Buzz on Can You Get Car Insurance Without A License In Pa - Save Money ...

Moms and dads need to consider adding their trainee driver to their car insurance policy as a provisional motorist. You do not drive, yet your student driver does, Say you buy a car for your teen's 16th birthday celebration when they obtain a chauffeur's permit. Also if you aren't driving the lorry, the auto will still require to be insured (auto).

And also if your teen is not old sufficient to be on their own plan, they would need to be noted as a driver on the plan of somebody age 18 or older.

If that is the situation, you will certainly not be able to obtain it back till you have revealed evidence of financial responsibility with an SR-22 certification. An SR-22 is not really insurance but is a certificate that verifies to the court that you have the minimum amount of responsibility insurance policy needed by your state. vehicle.

Note that lots of insurance coverage firms do not supply insurance coverage for unlicensed vehicle drivers or call for extra actions if they do. Below are some suggestions to help you obtain begun, although your best option is to consult with a licensed insurance agent. Inquire about an SR-22 certification, If your license is suspended, you might require to submit an SR-22 form or the equivalent in your state - credit.

The smart Trick of How Do I Get Car Insurance On A Vehicle Without A Valid Driver's ... That Nobody is Discussing

This can be important if you are attempting to buy vehicle insurance coverage when you do not have a license since you would be labeled a high-risk vehicle driver under this classification (prices). Acquire a plan with a person else as a noted vehicle driver, A main vehicle driver is the individual who is the proprietor of the automobile or a joint proprietor of a vehicle who drives the cars and truck the most.

Some insurance provider may need that the vehicle driver becomes part of your family, yet speak with a certified representative at your business to establish its demands. You'll need the person's determining details and chauffeur's permit number, but the auto proprietor need to additionally be detailed on the policy. Listing yourself as an excluded chauffeur on the policy, An omitted chauffeur is someone that your vehicle insurance will certainly not cover.

If you do not have a valid vehicle driver's certificate, it can be tough to purchase vehicle insurance. You might be able to get coverage if you consist of somebody else as the primary chauffeur and list yourself as an excluded driver on the plan. You can add on your own as an omitted motorist on the policy by informing your auto insurer that you would such as to exclude on your own from the plan as well as include another person as the primary chauffeur - car insured.

accident car insured insurance company auto

accident car insured insurance company auto

It's a lot much less arduous of a procedure to acquire an auto if you do have a permit, but you do not need to have one to do it - cheapest car. The specifications in which this can occur will certainly depend upon the automobile dealer's rules. You might require to show instant evidence of insurance policy for the deal to be shut.

The Main Principles Of Mandatory Insurance - Faq - Adot

Often asked concerns, Can you get car insurance coverage with a put on hold certificate? Yes, specific cars and truck insurance policy alternatives will be readily available to you with a suspended license.

cheapest car business insurance cheaper vehicle

cheapest car business insurance cheaper vehicle

SR-22s are a need for high-risk chauffeurs that confirms they carry the minimum necessary amount of obligation insurance coverage in their state. auto. Should I have insurance if I have a car yet not a permit? Yes, any vehicle you have that will be driven must be guaranteed, even if you don't have a valid driver's license.

Exactly how much auto insurance coverage do I need? Practically every state has a minimal quantity of car insurance policy protection that all chauffeurs are called for to bring. Most states call for motorists to lug bodily injury obligation insurance coverage and also residential property damage liability protection. Some states also need chauffeurs to have uninsured/underinsured motorist protection, and/or individual injury defense (PIP).

Regardless of your state's minimum requirements, a lot of insurance policy professionals advise acquiring complete insurance coverage auto insurance policy. Although complete insurance coverage insurance policy rates are greater, it supplies you much more monetary defense in the occasion of a protected loss.

Indicators on How To Get Car Insurance With No License - Bankrate You Should Know

However, if you are come by a law enforcement agent in Alabama and can not reveal evidence of insurance policy, you might encounter fines of approximately $1,000, a six-month suspension of your driver's permit, or both. Obtaining your permit restored after an insurance-related suspension will cost an added $200, and you will certainly need to reveal proof of insurance policy in order to get your permit back.

It's an initiation rite. cheaper cars. Your teenager has acquired his or her learner's authorization and can not wait to obtain behind the wheel. You have your very own reservations, not the least of which is what this will certainly mean in terms of insurance policy. The fact is, no matter if your child has an authorization or a certificate, they will certainly require vehicle insurance.

Picking the best cars and truck for your teen Normally, an automobile insurance coverage will cover a cars and truck and not always whoever is driving the vehicle, so one point you intend to determine very early is the kind of automobile your teenager will certainly be driving. Whether you intend on buying a brand-new vehicle for your teenager or using an automobile that runs in the family members, you'll wish to choose one with a high security score, as well as preferably not as showy or lavish - auto.

If you have alternatives, choose the automobile that has the cheapest insurance coverage prices to aid with the surge in costs. How does a new vehicle driver impact your automobile insurance policy? The truth is, when your teen comes to be a certified chauffeur as well as is contributed to your plan, your rates could boost substantially.

What Does Car Insurance Requirements And Laws By State - Geico Do?

Driving on the open road is no question a new as well as exciting experience for your teenager. A family driving agreement might be able to help you establish expectations and also goals for the brand-new vehicle driver in the family https://car-insurance-midlothian-il.s3.ams03.cloud-object-storage.appdomain.cloud/index.html members. prices.

Does Nevada enable Proof of Insurance to be presented on a cell phone? Yes - risks. Proof of Insurance coverage may be provided on a printed card or in an electronic format to be displayed on a mobile digital tool. Insurers are not called for to supply electronic evidence. However, they should constantly provide a published card upon request.

This will additionally inform you whether your vehicle registration is energetic as well as its expiry day. Why did I get a confirmation letter? Was I randomly chosen? Insurance Coverage Verification Notices are never ever arbitrary. Notices suggest we do not have a legitimate document of your liability insurance protection or that there is a possible lapse in the protection.

Commonly, this takes place when you transform insurance provider. You can upgrade your insurance coverage online. There are no poise periods. Just how do I react to the letter? There is no demand to check out a DMV workplace. You may respond online or by mail. The initial choice is to complete your reaction online utilizing the provided access code published on your letter.

The Buzz on In New York State, Can You Insure A Car Without A License?

insurance car insured low-cost auto insurance suvs

insurance car insured low-cost auto insurance suvs

If you have actually maintained continual insurance policy, you will certainly have the ability to enter your policy information. The internet site will allow you understand if the information you got in verified with your insurance business. If it does validate quickly, you will receive an adhere to up letter letting you recognize the occurrence has actually been fixed.

We will mail your response to your insurance policy company to allow them recognize we require your insurance documents for the lorry. The 2nd option is to complete the notice as well as mail it directly to our workplace. It is a business reply so there is no need for shipping. I lost the DMV letter, what can I do? There are a couple of choices to confirm your insurance.

I entered my insurance coverage details online yet it says "pending"? This means the insurance policy information you got in did not verify with your insurance policy business's data source quickly. It does not indicate you are not guaranteed. If you just acquired a brand-new policy, it may take several days for the business to validate it.

If you believe the DMV has inaccurate info, please call NVLIVE The info on documents can be investigated to confirm if you are needed ahead right into the workplace. Why did I receive a licensed letter? A licensed letter is the notice of a possible suspension. This might mean we did not obtain a response from the registered owner within the (15) days feedback time or the insurance provider did not reply to our notice within their (20) day reaction time (auto insurance).

Get This Report on What Happens If Someone Else Is Driving My Car And Gets In ...

You might not legitimately drive the automobile as of the suspension day detailed in the letter - insurers. The "neglect" letter implies your insurance coverage firm has actually reacted to the verification card sent to you by validating your insurance information.