A frequently suggested level of residential or commercial property damage coverage is $50,000 or more if you have substantial assets to secure. Medical Settlements (Med, Pay) or Individual Injury Security (PIP) Unlike bodily injury liability protection, clinical payments (Med, Pay) or accident security (PIP) covers the cost of injuries to the driver as well as any type of passengers in your car. insurance.

Whether medical settlements or PIP coverage is mandatory, optional, or perhaps offered will depend on your state (low cost). In states with no-fault insurance regulations, such as Florida as well as New York City, PIP coverage is required. In Florida, for instance, motorists should lug a minimum of $10,000. In New York, the minimum is $50,000.

, where $10,000 in coverage might be inadequate if you're in a significant accident. Crash Insurance coverage Accident coverage will pay to fix or change your automobile if you're included in a crash with one more automobile or strike some other things.

If you have a car funding or are leasing the car, your lending institution may require it. When you've paid off your lending or returned your rented automobile, you can go down the coverage. Even if it's not needed, you may wish to buy crash insurance coverage. If you 'd have problem paying a large repair costs out of pocket after a crash, crash protection can be good to have (affordable car insurance).

The rate of crash coverage is based upon the value of your auto, and also it generally includes a insurance deductible of $250 to $1,000. If your car would set you back $20,000 to replace, you 'd pay the very first $250 to $1,000, depending on the deductible you chose when you acquired your plan, and the insurer would certainly be accountable for as much as $19,000 to $19,750 after that.

The Best Guide To Compare 2022 Car Insurance Rates - Getjerry.com

Between the expense of your yearly costs and the deductible you 'd have to pay of pocket after an accident, you can be paying a great deal for very little protection (dui). Also insurer will certainly tell you that dropping crash insurance coverage makes feeling when your auto deserves less than a few thousand bucks.

risks liability insurance company affordable auto insurance

risks liability insurance company affordable auto insurance

As with extensive insurance coverage, states do not require you to have collision protection, but if you have an auto funding or lease, your loan provider may need it. And also once more, when you've paid off your loan or returned your rented auto, you can go down the protection.

You'll additionally want to take into consideration how much your cars and truck is worth compared with the expense of covering it year after year. Uninsured/Underinsured Driver Insurance coverage Just due to the fact that state legislations require drivers to have liability protection, that does not imply every vehicle driver does.

Some states need chauffeurs to bring uninsured motorist protection (). Some additionally need underinsured vehicle driver coverage (UIM).

auto auto low cost suvs

auto auto low cost suvs

If your state requires uninsured/underinsured vehicle driver insurance coverage, you can buy more than the required quantity if you wish to. You can additionally get this coverage in some states that don't require it (vehicle insurance). If you aren't required to buy uninsured/underinsured vehicle driver insurance coverage, you could desire to consider it if the insurance coverage you already have would certainly want to foot the bill if you're associated with a major accident.

The Single Strategy To Use For Best Car Insurance Buying Guide - Consumer Reports

Other Sorts of Insurance coverage When you're looking for automobile insurance coverage, you may see some various other, entirely optional sorts of protection - car insurance. Those can consist of:, such as towing, if you need to rent an auto while your own is being repaired, which covers any type of difference between your cars and truck's money value and what you still owe on a lease or finance if your auto is a failure Whether you require any one of those will certainly rely on what other sources you have (such as membership in a vehicle club) and also just how much you might manage to pay out of pocket if you must.

Whether to acquire greater than the minimum required protection and which optional sorts of coverage to think about will certainly depend upon the properties you need to protect in addition to just how much you can afford to pay. Your state's motor automobile division web site ought to explain its requirements and also might offer other guidance particular to your state.

One of the most significant elements for consumers looking to acquire cars and truck insurance policy is the cost. Not just do prices vary from company to business, yet insurance coverage costs from state to state differ.

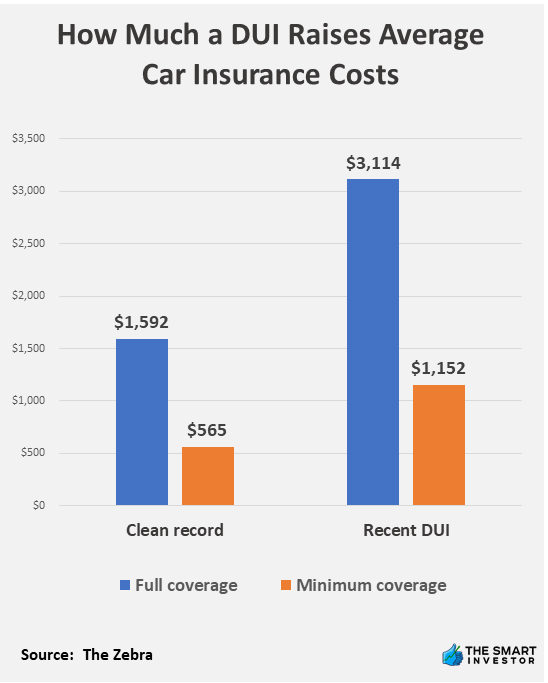

Insurance firms utilize numerous aspects to determine prices, and you might pay essentially than the average motorist for protection based on your threat profile. For example, more youthful vehicle drivers are usually more probable to get involved in a crash, so their premiums are commonly higher than average. You'll additionally pay even more if you have an at-fault crash, multiple speeding tickets, or a DUI on your driving document.

Keeping the minimum quantity of insurance coverage your state needs will permit you to drive legally, and also it'll set you back much less than full protection. It may not give adequate protection if you're in an accident or your vehicle is harmed by another covered event. Curious regarding how the average price for minimum coverage stacks up against the price of full protection? According to Insurify.

Getting My Tesla Insurance To Work

car insured low cost auto car insurance insured car

car insured low cost auto car insurance insured car

However the only way to know exactly how much you'll pay is to search and get quotes from insurance providers. Among the elements insurance providers utilize to identify prices is location. Individuals who reside in locations with higher burglary rates, accidents, and natural disasters commonly pay even more for insurance policy. And also since insurance coverage legislations as well as minimal protection demands vary from state to state, states with higher minimum requirements commonly have higher ordinary insurance policy expenses (business insurance).

Many but not all states permit insurance provider to make use of credit history when setting prices. As a whole, candidates with reduced scores are more probable to file a case, so they generally pay much more for insurance coverage than vehicle drivers with higher credit rating. If your driving record includes crashes, speeding tickets, Drunk drivings, or other violations, expect to pay a higher premium.

Cars and trucks with greater rate tags generally set you back more to insure. Vehicle drivers under the age of 25 pay higher prices due to their absence of experience and raised crash threat.

Because insurance coverage companies have a tendency to pay more cases in risky locations, prices are usually greater. Obtaining sufficient coverage might not be inexpensive, but there are means to get a discount on your car insurance policy.

If you possess your residence rather than leasing it, some insurers will give you a discount rate on your vehicle insurance coverage premium, also if your house is insured through another firm. Besides New Hampshire and Virginia, every state in the country calls for chauffeurs to preserve a minimum quantity of liability protection to drive legally.

What Is The Average Cost Of Auto Insurance? - Moneygeek Fundamentals Explained

It may be appealing to stick to the minimum restrictions your state calls for to conserve on your premium, but you could be placing yourself in jeopardy (cheap insurance). State minimums are infamously reduced as well as might leave you without adequate defense if you remain in a significant accident. Most experts suggest keeping enough protection to protect your possessions.

Insurance policy service providers wish to see demonstrated accountable actions, which is why traffic accidents and also citations are aspects in establishing car insurance low cost coverage prices. Remember that aims on your permit don't stay there forever, however the length of time they remain on your driving record varies depending upon the state you live in and also the seriousness of the infraction.

A new sporting activities cars and truck will likely be more costly than, claim, a five-year-old car. auto. If you select a lower insurance deductible, it will certainly cause a greater insurance bill which makes choosing a greater deductible feel like a rather excellent offer. A higher insurance deductible might mean paying more out of pocket in the occasion of an accident.

What is the average auto insurance coverage price? There are a wide range of aspects that influence just how much auto insurance policy costs, that makes it challenging to obtain a precise suggestion of what the average person pays for car insurance policy - insurance affordable. According to the American Automobile Organization (AAA), the typical expense to insure a car in 2016 was $1222 a year, or around $102 each month.

Nationwide not just uses affordable prices, but additionally an array of discounts to help our participants conserve also a lot more. How do I get automobile insurance? Obtaining a vehicle insurance quote from Nationwide has actually never been less complicated. Visit our auto insurance policy quote section as well as enter your postal code to begin the vehicle insurance policy quote process - prices.

More About Best Car Insurance Companies Of April 2022 – Forbes Advisor

Likewise, if you have a history of having car insurance policies without filing cases, you'll get more affordable rates than somebody that has submitted claims in the past.: Cars that are driven much less frequently are less likely to be included in an accident or other destructive event. Automobiles with lower annual gas mileage may certify for somewhat lower rates.

To discover the ideal car insurance policy for you, you need to comparison shop online or talk with an insurance policy representative or broker. You can, however be sure to track the insurance coverages chosen by you and also used by insurance companies to make a fair comparison. You can that can help you locate the best combination of cost and also fit.

vans cheaper auto insurance cheaper cars auto insurance

vans cheaper auto insurance cheaper cars auto insurance

Independent agents help numerous insurer and can compare among them, while restricted agents help just one insurance provider. car insured. Offered the different score techniques and factors made use of by insurance companies, no single insurance policy business will certainly be best for everyone. To better understand your common auto insurance coverage cost, spend time comparing quotes across companies with your chosen technique.

Having the appropriate information in hand can make it easier to obtain an accurate automobile insurance coverage quote. You'll wish to have: Your driver's license number Your car recognition number (VIN) The physical address where your automobile will be saved You may likewise intend to do a little research study on the kinds of insurance coverages available to you.